Digital Assets - The 5th Asset Class

- Adaptive Alph

- Mar 12, 2022

- 8 min read

Crypto: The Fifth Asset Class

In the beginning of 2022, the world is experiencing record high inflation, debt levels and geopolitical instability, which in combination with extremely negative real interest rates means that investors must review their strategic asset allocations. Common for all investors is balancing risk and reward to achieve an investment objective, which can range from a consumer saving for retirement to a firm maximizing shareholder value. The main tool for balancing risk and reward is leveraging asset allocation by spreading risk across asset classes, which include equities, fixed income, currencies and commodities. In addition to the big four legacy markets, there are derivatives, alternative investments and real estate, but I argue that derivatives and alternatives are layers on top of traditional asset classes and that real estate is a form of commodity. Since bitcoins creation in 2008, the digital asset space has grown exponentially and as of February 2022, the crypto market capitalization was valued at over 2 trillion dollars, which is large enough to be considered as a new asset class. However, before cementing crypto as a new asset class there are other thresholds that also needs surpassing. The first step in cementing crypto as an asset class is to find out what defines an asset class. The second step is comparing regulation between digital and other asset classes. The third step is measuring statistical relationships between the digital and legacy markets and the final step is analyzing performance drivers behind digital assets.

Simplification of asset class analysis

Crypto Asset Class: Definition

Investopedia defines an asset class as a grouping of investments that exhibit similar characteristics and are subject to same laws and regulation. Per Investopedia’s definition, equities and fixed income are different asset classes as equities and fixed income represent ownership and debt respectively. Ownership and debt involve two completely different risk profiles. For example, in the case of a firm bankruptcy, bond holders are paid first and equity holders last meaning that fixed income and equity return characteristics are different. Commodities are divided into market subgroups including energies, metals and agrarians, and each subgroup serve a similar economic purpose. For example, the economic purpose of electricity is to power a machine and that electricity in turn is generated by another commodity like oil. A precious metal like gold, however, is used to conduct electricity or as a store of value and is therefore in a different commodity subgroup than oil. Unlike commodities, fiat currencies serve as a medium of exchange, unit of account and store of value. As commodities are physical goods and currencies is a tool for exchanging goods and services, the risk reward profiles between currencies and commodities are different. By defining asset class and reviewing how asset classes in the legacy market are different, we can now move forward to analyze crypto as a new asset class by comparing regulation, measuring statistical relationships, and analyzing performance drivers.

Legacy Market Asset Classes (Could include Hedge Funds, Private equity, Real Estate, VC)

Crypto Asset Class: Regulation

Regulations and laws in financial markets are used to establish trust between market participants and to protect against predatory or illegal practices. In the US, the SEC and CFTC regulates equity, fixed income, commodity and currency markets. CFTC and SEC in turn delegates some responsibility to NFA and FINRA, which are self-regulatory agencies. For example, self-regulation means that commodity market participants enforce regulation on themselves, as they are primary benefactors and have greatest understanding of commodities. The point of self-regulation is simply to make sure resources are productive. Unlike the digital asset space, the legacy market is filled with intermediaries. For example, in equities intermediaries include brokers, banks, underwriters, clearing corporations and mutual funds and for commodities there are CPOs, CTAs, FCMs, and IBs. These intermediaries are important for regulators because they store lots of data on market participants, which can serve as leverage and evidence against bad actors. Although there are centralized crypto exchanges like Coinbase, the digital asset space tends to remove intermediaries through the blockchain which worries politicians. In traditional markets, banks monitor dollar transfers, but in crypto, computers instead monitor transactions. The benefit of computers monitoring transfers is that they receive a fraction of the bank fee, as the bank must pay salary to its employees. The blockchain is a decentralized database consisting of many different computers in different jurisdictions making digital asset regulation difficult. The Chinese BTC ban in combination with El Salvadorian adoption, American regulation and Swedish division means that global regulatory bodies are out of sync on digital asset regulation. Simply put, crypto regulation will differ from legacy markets as the digital asset space is more decentralized. Future crypto regulation, however, will mature with education plus trial and error.

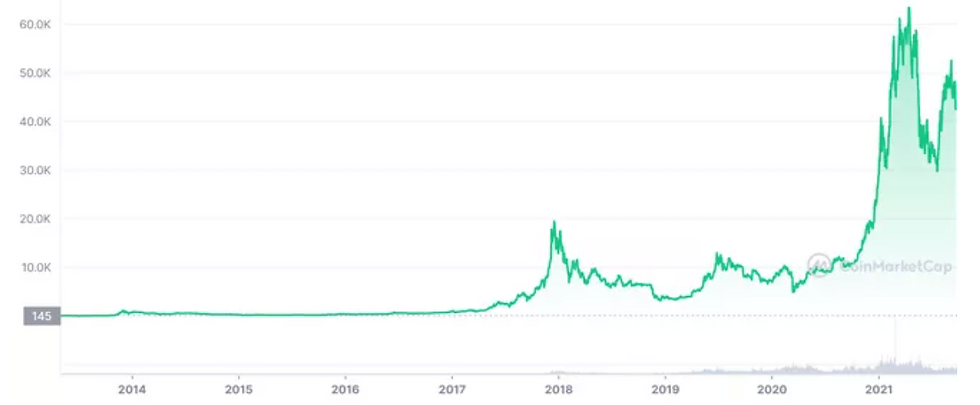

Bitcoin Price Chart

Crypto Asset Class: Statistical Relationship

The holy grail for investors is maximizing Sharpe by generating as much money as possible with the lowest amount of risk by blending asset classes based on return, volatility and correlation. To achieve a high Sharpe, pension funds, individual investors and endowments develop a strategic asset allocation, which consists of uncorrelated return streams. At a high level, the typical institutional portfolio includes a large passive equity and fixed income portion in combination with a smaller portion of real estate/natural resources, PE/VC and hedge funds. Factors driving equity and fixed income markets therefore dominates the return profile of institutional portfolios, while commodities and currencies are generally used to lower the overall risk-taking based on statistical relationships with equity and fixed income factors. Besides appropriate regulation, institutional investors will include digital assets in a strategic asset allocation if the crypto coins, tokens, companies and projects either generate a high level of return or lower the amount of portfolio risk.

Crypto Asset Class: Statistical Relationship Part2

To make the statistical analysis simple, bitcoin and the S&P500 serve as market risk proxies for the digital asset space and legacy market respectively (keep in mind that there is a wide range of coins, tokens, projects and companies that solve unique problems in legacy markets).

1. Return

Per the DQYDJ return calculator, bitcoin has generated a return of 265% annualized for the period March 2011 until March 2022 [1]. This return can be compared to the 12% annualized for the S&P500 during the same period. That means 1 USD invested in bitcoin is now worth 46,000 USD, while the same dollar is worth less in S&P500. Obviously, bitcoin compounding at 265% going forward is difficult to foresee as digital markets mature, but bitcoin’s large outperformance over S&P500 is an argument for the digital asset space as a unique asset class.

2. Volatility

Per the Marketmilk volatility calculator, the annualized bitcoin price volatility spanning the last 3 years was 163%, which is much higher than the approximately 15% realized historically by S&P 500[2]. Risk and reward of bitcoin likely means that the digital asset space is more of a return driver than risk mitigator in an investment portfolio.

3. Correlation

The final data point to analyze between bitcoin and the legacy market is historical correlation using different lookback periods, which depict how the digital asset space perform on a relative basis. Per the Yahoo finance calculator, the 14 day rolling correlation as of March 2022 between bitcoin and S&P 500 is 0.83, but spanning the past 5 years, the correlation has fluctuated between -0.5 and 0.8 suggesting a spurious relationship. If instead analyzing 30, 50 and 100 day lookbacks, the correlation fluctuates as well as per Figure 1. Per the 100 day lookback, however, the correlation between BTC and S&P is at a record high 0.86 as of March 2022. Despite the high correlation using a 100 day lookback, I would argue that the digital asset space is its own asset class based on the return and volatility of BTC compared S&P500. Obviously, history is not necessarily indicative of the future, as statistical relationships breakdown.

Figure 1 as of March 2022

Fluctuating Correlations

Crypto Asset Class: Characteristics

The perhaps most important factor for determining a stand-alone asset class is reviewing the characteristics driving performance of the underlying assets. So how are digital assets different from legacy assets from a performance perspective? Well, the digital asset space includes coins, tokens, projects and companies. These digital sub-asset classes listed below use technology to remove intermediaries, generate liquidity, pool resources, create communities, improve transparency, prove ownership and originate art.

- Privacy, Stable coin, Currency, Commodity backed, Remittance, Platform, DeFi, Exchange, DAO, Metaverse

At the most fundamental level, cryptos come in two forms; tokens and coins. Tokens represent ownership, while coins represent what investors could potentially own. Bitcoin is a crypto coin meaning that bitcoin behaves more like currencies than equities. Bitcoin’s original function was to facilitate peer to peer transactions similar to dollar transactions, but at a much slower and expensive rate and is therefore not a great replacement for fiat. However, in addition to peer to peer transactions, bitcoin also behaves like gold because there is a limited supply of 21 million bitcoin. Unlike fiat, no government can control the bitcoin supply or print more bitcoin. Instead bitcoins are created as a reward to puzzle solving blockchain miners. These miners also validate transactions on the network. All crypto coins like bitcoin operate on their own blockchains. Ethereum, for example, is also coin, but unlike bitcoin, the Ethereum blockchain allows for smart contracts, which can be used for a range of tasks including DeFi yield farming and token creation.

Crypto Asset Class: Characteristics Part 2

A smart contract is a form of immutable code that creates trust between two or more untrusting parties for purposes other than simple peer to peer transactions. Most crypto projects and companies are built on smart contracts and as a result, the digital token ecosystem has exploded. Unlike coins like bitcoin or Ethereum, tokens like Uniswap, IMX or NFTs do not own a blockchain. Tokens are actually more similar to equities as tokens represent ownership. The difference is that equity ownership is stored centrally with a broker, while tokens are registered in an immutable wallet address. Uniswap is a governance token for a DeFi platform and IMX is a token used to purchase NFT’s on the ImmutableX network. The ImmutableX network is built on top of the Ethereum blockchain and IMX is therefore a level 2 token. Like Ethereum, holders of IMX can stake their coins to earn a share of the transaction fees generated by all NFT’s bought and sold on the ImmutableX platform. If users love NFT projects on the ImmutableX platform, then transactions will generate a higher yield to holders of IMX, which increases the value of the ImmutableX platform. NFTs traded on platforms like ImmutableX are unique and some of these NFT projects like bored apes are valued like Van Gogh paintings. Basically, tokens represent ownership, while coins represent what the owner could potentially own. Coins and tokens including NFT’s can also be placed in collateral with DeFi lending platforms like Aave. In return for lending out tokens, the lender earns a token yield similar to a legacy market fixed income instrument. Corporations or individuals needing liquidity can tap into these DeFi pools instead of the debt market to raise capital for projects. Like Commodities, cryptos can be divided into subgroups based on economic objectives so even within the digital asset space there is a great deal of idiosyncrasy. Given all the new use cases developed through coins, tokens and blockchains, the underlying return drivers in the crypto space are unique when compared to factors driving legacy markets.

Tokens Vs Coins

Conclusion

By breaking down the digital asset space into four components through defining asset class, comparing regulation, measuring statistical relationships and analyzing performance drivers, I conclude that the digital asset space deserves to be its own asset class. Investors that are looking to generate a higher Sharpe should at minimum allocate 5% of their portfolios to digital assets. If that means passively investing in bitcoin or utilizing a more complex DeFi strategy is up to the investor. The digital asset space performance and statistical relationship with legacy markets is too good of an opportunity for investors to pass up.

[1] https://dqydj.com/bitcoin-return-calculator/ [2] https://marketmilk.babypips.com/symbols/BTCUSD/volatility?source=coinbase

Comments